Page 45 - CCCA63_2009

P. 45

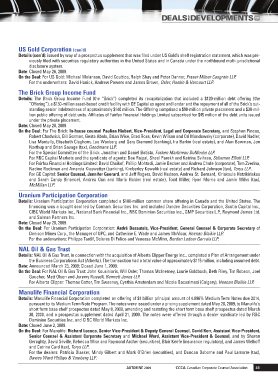

CCCA_V3No3_Col-DealDevelop-FIN.qxd:CCCA_V1No2_Col-News-V1.qxd 9/16/09 10:24 AM Page 45 US Gold Corporation (con’d) AND Details (con’d): issued by way of a prospectus supplement that was filed under US Gold’s shelf registration statement, which was pre- viously filed with securities regulatory authorities in the United States and in Canada under the northbound multi-jurisdictional disclosure system. Date: Closed May 26, 2009. On the Deal: For US Gold: Michael Melanson, David Coultice, Ralph Shay and Peter Danner, Fraser Milner Casgrain LLP. For the underwriters: David Hanick, Andrew Powers and James Brown, Osler, Hoskin & Harcourt LLP. The Brick Group Income Fund Details: The Brick Group Income Fund (the “Brick”) completed its recapitalization that included a $120-million debt offering (the “Offering”), a $130-million asset-based credit facility with GE Capital as agent and lender and the repayment of all of the Brick’s out- standing senior indebtedness of approximately $140 million. The Offering comprised a $90-million private placement and a $30-mil- lion public offering of debt units. Affiliates of Fairfax Financial Holdings Limited subscribed for $45 million of the debt units issued under the private placement. Date: Closed May 28, 2009. On the Deal: For The Brick: In-house counsel Paulina Hiebert, Vice-President, Legal and Corporate Secretary, and Stephen Pincus, Robert Chadwick, Bill Gorman, Gesta Abols, Brian Wise, Brad Ross, Kevin Wilson and Ori Mandowsky (corporate), David Nadler, Lisa Mantello, Elisabeth Cleghorn, Lee Waxberg and Gary Diamond (banking), Ira Barkin (real estate), and Alan Bowman, Jon Northup and Brian Savage (tax), Goodmans LLP. For the Special Committee of the Brick: Jonathan and Daniel Batista, Fasken Martineau DuMoulin LLP. For RBC Capital Markets and the syndicate of agents: Dee Rajpal, Sheel Parekh and Katrina Svihran, Stikeman Elliott LLP. For Fairfax Financial Holdings Limited: David Chaikof, Phillip Mohtadi, Jamie Becker and Andrea Chafe (corporate), Tom Zverina, Nadine Rockman and Amanda Kieswetter (banking), Kimberley Kowalik (real estate) and Richard Johnson (tax), Torys LLP. For GE Capital: Senior Counsel, Jennifer Guerard, and Jeff Rogers, David Hudson, Andrea St. Bernard, Kiriakoula Hatzikiriakos and Sarah Candy (finance), Andrea Onn and Maria Holder (real estate), Todd Miller, Ryan Morris and Jamie Wilks (tax), McMillan LLP. Uranium Participation Corporation Details: Uranium Participation Corporation completed a $100-million common share offering in Canada and the United States. The financing was a bought deal led by Cormark Securities Inc. and included Dundee Securities Corporation, Scotia Capital Inc., CIBC World Markets Inc., National Bank Financial Inc., RBC Dominion Securities Inc., GMP Securities L.P., Raymond James Ltd. and Salman Partners Inc. Date: Closed May 28, 2009. On the Deal: For Uranium Participation Corporation: André Desautels, Vice-President, General Counsel & Corporate Secretary of Denison Mines Corp., the Manager of UPC, and Catherine E. Wade and James McVicar, Heenan Blaikie LLP. For the underwriters: Philippe Tardif, Dolores Di Felice and Vanessa McMinn, Borden Ladner Gervais LLP. NAL Oil & Gas Trust Details: NAL Oil & Gas Trust, in connection with the acquisition of Alberta Clipper Energy Inc., completed a Plan of Arrangement under the Business Corporations Act (Alberta). The transaction had a total value of approximately $115 million, including assumed debt. Date: Announced March 23, 2009; Closed June 1, 2009. On the Deal: For NAL Oil & Gas Trust: John Kousinioris, Will Osler, Thomas McInerney, Laurie Goldbach, Beth Riley, Tim Robson, Joel Gaucher, Matt Olson and Jeremy Russell, Bennett Jones LLP. For Alberta Clipper: Thomas Cotter, Tim Sweeney, Cynthia Amsterdam and Nicole Bacsalmasi (Calgary), Heenan Blaikie LLP. Manulife Financial Corporation Details: Manulife Financial Corporation completed an offering of $1 billion principal amount of 4.896% Medium Term Notes due 2014, pursuant to its Medium Term Note Program. The notes were issued under a pricing supplement dated May 28, 2009, to Manulife’s short form base shelf prospectus dated May 8, 2009, amending and restating the short form base shelf prospectus dated March 30, 2009, and a prospectus supplement dated April 21, 2009. The notes were offered through a dealer syndicate led by RBC Dominion Securities Inc. and CIBC World Markets Inc. Date: Closed June 2, 2009. On the Deal: For Manulife: Richard Lococo, Senior Vice-President & Deputy General Counsel, David Kerr, Assistant Vice-President, Senior Counsel & Assistant Corporate Secretary and Michael Ward, Assistant Vice-President & Counsel, and by Sharon Geraghty, David Seville, Rebecca Wise and Raymond Archer (securities), Blair Keefe (insurance regulatory), and James Welkoff and Catrina Card (tax), Torys LLP. For the dealers: Patricia Olasker, Mindy Gilbert and Mark O’Brien (securities), and Duncan Osborne and Paul Lamarre (tax), Davies Ward Phillips & Vineberg LLP. AUTOMNE 2009 CCCA Canadian Corporate Counsel Association 45